State Employee Healthcare Premium Increases for Plan Year 2025

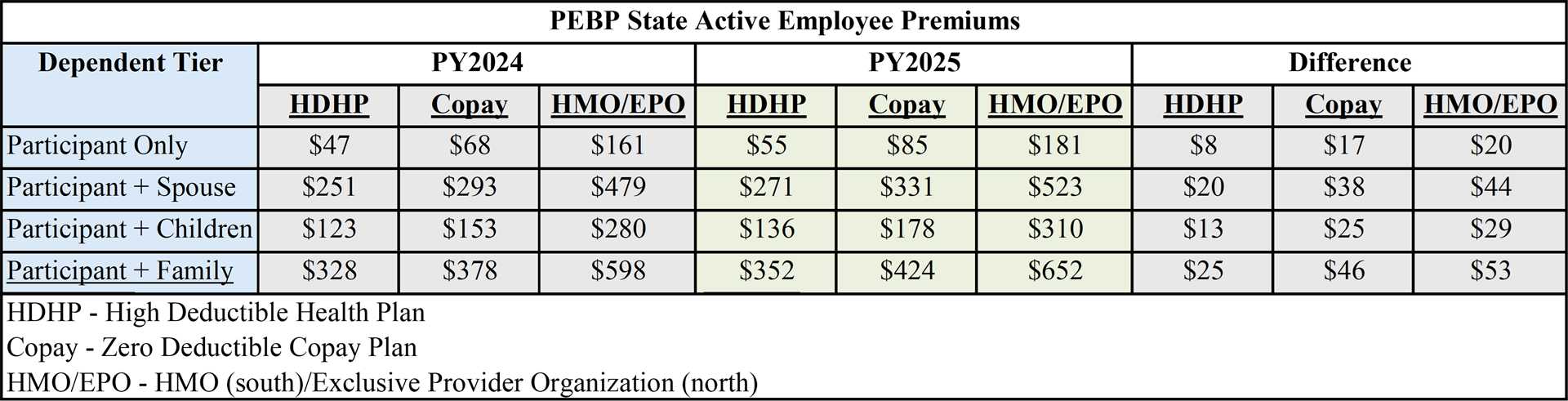

The Public Employees’ Benefits Program (PEBP) Board has approved increases to employee premiums for Plan Year 2025. Beginning July 1, 2024, monthly premiums will increase by $8 to $53 (percentage increases from 8% to 25%) depending on your plan choice and dependent tier, as shown in the following table.

Most plan provisions will remain the same for FY2025. PEBP is implementing a centers-of-excellence program for specific surgeries and a cancer treatment concierge program, intended both to save money and help patients get better treatment. Some changes, however, will increase participants’ out-of-pocket costs. High out-of-pocket costs force some participants to forgo necessary medical care. The deductible for the High Deductible Health Plan (HDHP) will increase from $1500/$3000 (single/family) to $1600/$3200 because of a higher IRS minimum for eligibility for Health Saving Accounts (HSAs). The supplemental contributions to HSAs or Health Reimbursement Accounts (HRAs) for all three plans will decrease from $600/$700/$800 (single/spouse or children/family) to $300/$400/$500, while the regular HSA/HRA contribution to the HDHP remains at $600.

Why Rates are Increasing

Each year, the PEBP actuary predicts medical inflation trends. Governor Lombardo used lower trends than those predicted by the actuary to design the 2023–25 executive budget for PEBP, and the legislature adopted those low trends. Because FY2024-to-date expenses and the actuary’s projection for FY2025 now indicate higher expenses, PEBP must fund the higher costs through employee premium increases or with reserves. Without using reserves, the employee premium increases would have been twice those shown in the table above. However, PEBP is potentially dipping into the Catastrophic Reserve (formerly known as the rate stabilization reserve) to mitigate employee costs.

PEBP Reserves

As of December 2023, PEBP’s total cash balance was $121 million, including $42 million in the Catastrophic Reserve. The cost to mitigate 50% of the employee premium increases for FY2025 is $7.3 million. Although PEPB will not go broke, spending reserves below the mandatory levels set by the actuaries means the difference must be made up in the next budget cycle. However, we won’t know whether the reserves are being depleted until the close of each fiscal year.

For the past dozen years, as the following chart shows, PEBP has often generated excess reserves because actual claims have come in lower than projected, especially after benefit cuts. Excess reserves are cash balances above the mandatory reserves set by the actuary, and have ranged up to tens of millions of dollars. Although excess reserves declined in FY2023 and FY2024, because they partially restored benefits cut during the pandemic, these reserves have never gone negative. However, the excess reserves have helped the governor and legislature justify lower budgets for PEBP. The result is that PEBP’s actuaries predict shortfalls, inducing PEBP to raise employee premiums or cut benefits. This perversely leads to the generation of more excess reserves.

NFA Positions

Given the realities of PEBP funding, these more moderate premium increases approved by the PEBP Board are about the best that can be done at this time. Therefore, NFA supported the 50% mitigation plan over the alternatives of higher charges to employees. We appreciate that PEBP Executive Officer Celestena Glover proposed the mitigations after the initial plan for higher employee premium increases was announced.

However, the NFA believes that the state should pay 100% of single-employee premiums in the basic plan, as most local governments in Nevada do this for their employees. Benefits have been cut or employee premiums have been raised every time there has been a budget shortfall or projected shortfall. PEBP should use its ample reserves instead of making employees pay for fluctuations in claims that are typical of any self-funded insurance plan. The State should be responsible for funding stable benefits for its employees.

###

The Nevada Faculty Alliance has strongly advocated for faculty and other state employees with the Public Employees Benefits Program since the PEBP Board was established in 1999 and before that with the state Committee on Benefits. It is a constant battle to maintain benefits and keep employee costs in check. Currently, Kent Ervin and Doug Unger represent NFA members at every PEBP Board meeting and meet regularly with PEBP staff along with our public employee advocate partners. To support these efforts on your behalf, join NFA now if you are not already a member.

NFA would like to hear members’ concerns about PEBP. Contact kent.ervin@nevadafacultyalliance.org or doug.unger@nevadafacutlyalliance.org. You may also contact the NSHE representatives on the PEBP Board, Michelle Kelley (mkelley@nshe.nevada.edu) or Jennifer McClendon (jmcclendon@unr.edu).